rpgt rate malaysia 2018

72020 7102020 - Refer Year 2020. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Real Property Gains Tax After Death Rockwills Info

With effect from YA 2008 where a SME first commences operations in a year of assessment the SME is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment.

. For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. Real Property Gains Tax RPGT Rates.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Received Masteel Dividend - 21 August 2018 4 years ago 阿Boon生活笔记本 Boons Life Diary. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. Superior Tax Comp Superior ComSec Superior TimeCost Superior.

Kajang SILK new toll rate oh Kajang SILK new toll rate 3 days ago. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Year Assessment 2017 - 2018. 62018Taxation Of A Resident Individual Part III. ALR Rate for May Jun July 2022.

Malaysia Personal Income Tax Rate. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Basic supporting equipment for disabled self spouse child or parent. 01042018 - Refer Year 2018. The non-citizen must receive a monthly salary of 25000 ringgit or more hold the C-suite position for at least 5 consecutive years and be a tax resident for each year he is assessed using the flat rate.

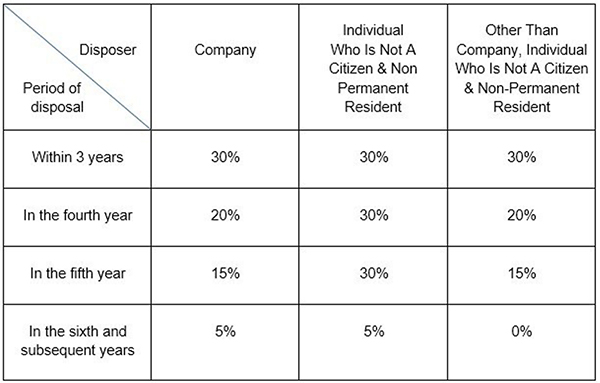

Real Property Gains Tax RPGT Rates. Real Property Gains Tax RPGT Rates. Malaysia Sales Tax 2018.

Flat to Effective Interest Rate Calculator. SST Treatment in Designated Area and Special Area. Richards Investment in US Malaysia Stock Market.

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. 603 8313 8888 Fax. This post is also available in.

SUPERIOR IT SOLUTIONS SDN. RPGT rate for disposal of chargeable asset under Part I. RPGT in Malaysia 2022 How Inflation Affects Loan Installments.

For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. While RPGT rate for other categories remained unchanged.

Real Property Gains Tax RPGT Rates. Ducation fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

And if the Tenancy Agreement has been signed for more than 3 years the. Headquarters Inland Revenue Board of Malaysia Level 12 Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor MALAYSIA. RM220 RM0 RM279 RM014.

Real Property Gains Tax RPGT Rates. RM220 RM0 RM281 RM002 RM218 RM0 1 - 31 Oct 2018. Moreover non-citizen personalities who hold key positions in companies looking to relocate in Malaysia are taxed at a flat rate of 15.

Malaysian Taxation on Foreign-Sourced Income. Rights Issue 8 RPGT 2 Rubberex 1 SAM 2. Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia.

603 8313 7848 e-mail. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this. W-01A-275-042018 Case Report Tax Appeal before the Special Commissioners of Income Tax. For detail of informstion on RPGT reference can be made to the RPGT Guidelines dated 13062018 or 1806.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

Malaysia Service Tax 2018. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Example 11 amended on 25092018 Superceded by the Public Ruling No.

The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-. Many investors own real properties in Malaysia as part of their investment portfolio and receive rental from them. Real Property Gains Tax RPGT Rates.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Melayu Malay 简体中文 Chinese Simplified Estimate of Tax Payable in Malaysia. Car.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Are taxed at flat rate of 28.

Understand the income tax rate and type in Malaysia will help your business stay in good compliment. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Amazon Com Madjtlqy Little Girls Jumpsuit With Pocket Summer Casual Harem Overall Romper Toddler Kids Cute One Piece Outfits 2 6t Black Marine Animal 2 3t Clothing Shoes Jewelry

Sept Dec 2018 Q Strategic Professional Options Advanced Taxation Malaysia Atx Mys Studocu

What Is Real Property Gains Tax Rpgt In Malaysia 2021

What Is Real Property Gains Tax The Star

Legal Tax Developments In Malaysia Baker Mckenzie

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Malaysia S Budget 2020 Rodl Partner

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

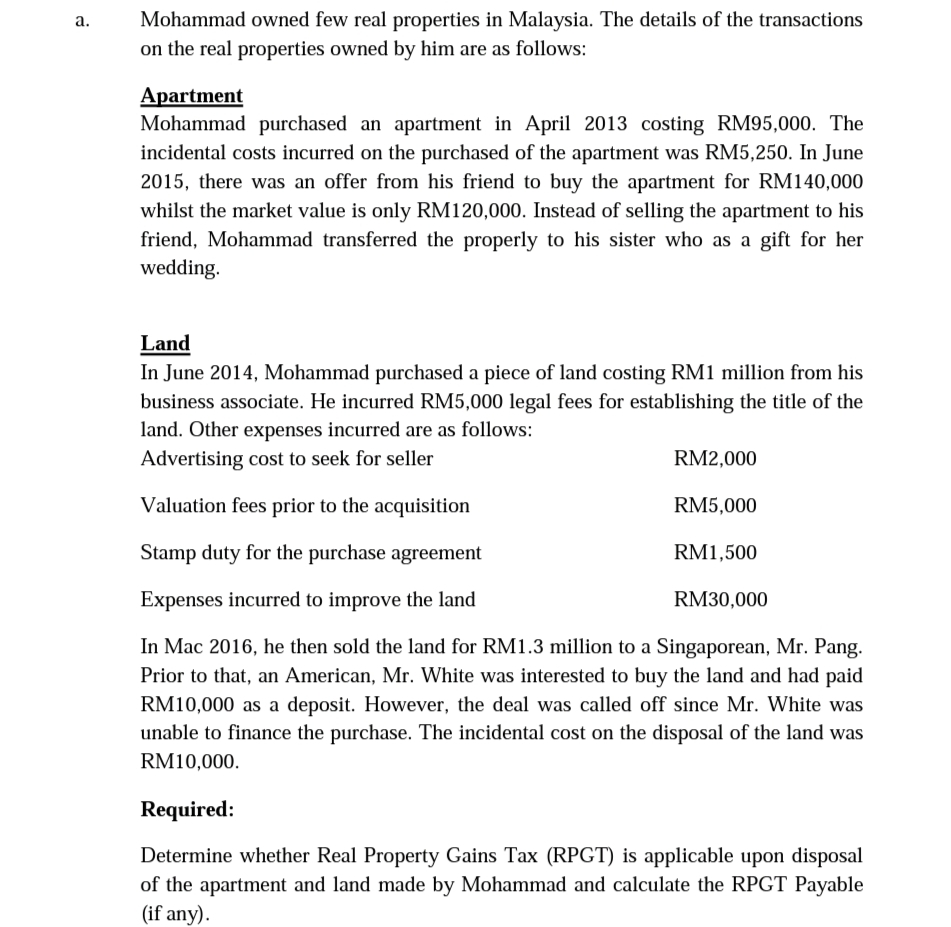

Answered A Mohammad Owned Few Real Properties Bartleby

Pdf The Effects Of House Price And Taxation On Consumers Burden The Case Of Malaysia

Malaysia S Rpgt 2019 More Pain Less Gain

Malaysia Rpgt Stamp Duty Changes 2019 Youtube

Do You Know That The Perpetual 5 Rpgt Is A Tax On Inflation Iproperty Com My

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

Full Article Housing Bubble Affordability And Credit Risk To Banks A Malaysian Perspective

0 Response to "rpgt rate malaysia 2018"

Post a Comment